Let me say at the outset that this article doesn’t talk about Jesus, and is therefore slightly outside of the purpose of this blog. Yet I write this article because I’m wrestling with two potential options for wealth building which are before me. The one path is tried and tested: rental real estate. The other is the new emerging market that is taking the world by storm: Bitcoin. Which of these two options is best suited to build wealth for the future? As I scoured the internet to find a decent article that fairly weighs the two asset classes I could not find anything, so I’ve decided to write something myself.

Real estate is a tried and true method for building wealth. It is where the majority of home owners keep most of their net worth (through their primary residence), and rental real estate is an excellent way to become rich. Buying a cash-flowing rental property in a good location is seen as a smart and secure investment by just about everyone, even the banks. So much so that they will lend you 80% of the cost of the property to buy it, and if you’re already a home-owner, they’ll often even allow you to borrow money from your primary residence for the down payment! You can even work the magic so that your ROI can be “infinite,” as you later pull your downpayment back out of the property through a re-appraisal and own it free and clear. Everything else that comes in is bonus.

When you invest in rental real estate you earn in 3 ways: 1) Cashflow – your net income each month after collecting rent and paying your expenses. 2) Debt pay-down – your tenants are paying your mortgage such that in 25 or 30 years, you own it free and clear. 3) Appreciation – if you buy in a good location, the property value will generally go up over time, as you can see by the price chart of major Canadian cities below.

Here’s the point: real estate can be very lucrative. It is a tried and tested method for gaining wealth. In fact, over the last two centuries, 90% of the world’s millionaires have been created through investing in real estate.

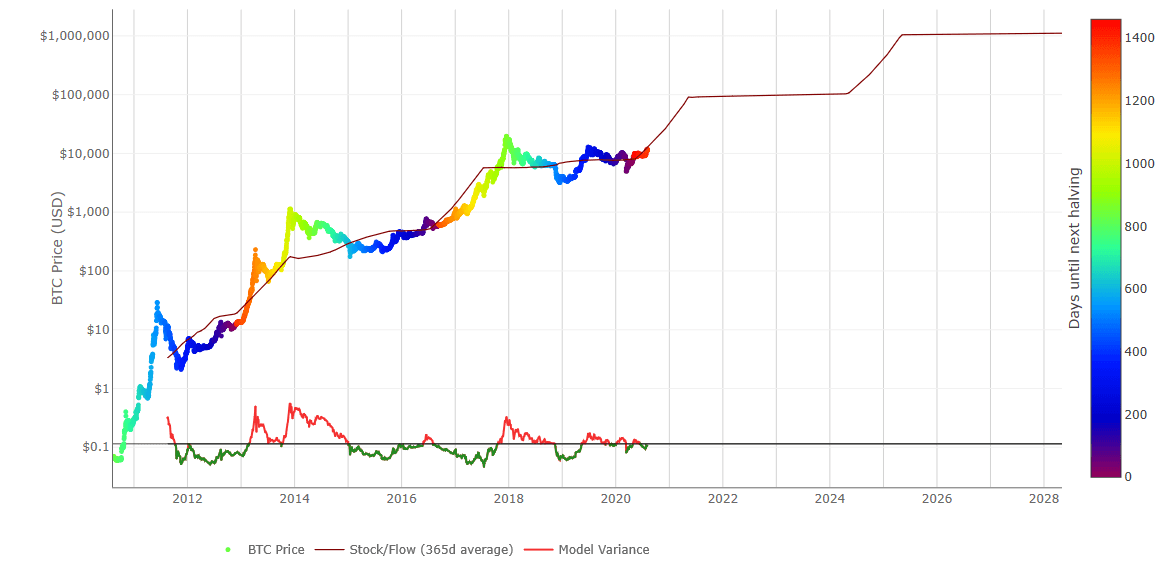

Bitcoin, being a new asset class is a much less proven way to build wealth. That said, over the past decade it has shown itself to be far and away the fastest horse in the race. So far Bitcoin has followed an upward trend that is highly correlated to its halving cycle. If that trend continues, each Bitcoin will be worth around $1 million USD sometime in 2025, as seen in this logarithmic graph below:

But why would it stop there? If Michael Saylor is correct and we someday see a $100 trillion USD market cap for Bitcoin, each coin will be worth about $5 million USD – that’s 100x what it is today. Many will say this is a really big “if,” but let’s play out the scenario. What will be the comparison of real estate to Bitcoin if Saylor hits his ultimate price target?

Residential real estate in the world today currently comprises $355 trillion CAD. That’s the value of all the homes in the entire world, right now. The average house price in my city is about $600 000 CAD or 10 Bitcoin at the time of writing. Let’s say this is my house. This means that my humble home here in Canada represents 0.0000000017th of the total residential real estate in the world. It’s tiny… it’s a pea. And yet it’s worth 10 whole Bitcoin at Bitcoin’s current price! So I must ask myself, in a world where everything is priced in Bitcoin, should my house be that valuable?

There are only 21 million Bitcoin that will ever exist. Under a Bitcoin Standard, does it make sense that my little house would account for 10/21 000 000th of the world’s wealth? Absolutely not. Assuming a Bitcoin standard, the true value of my house today is 0.036 Bitcoin.

Another way to think of this is: I could put $60 000 into buying 1 rental property today (with partners, mortgage, etc). Or I could put $60 000 into Bitcoin today, and then buy 278 homes in the future, given Saylor’s price prediction, assuming real estate is stagnant. But even if real estate prices increases 10x, the debt is all paid down, and cashflow is solid, over that same time frame, I’m still way ahead having put the original investment into Bitcoin.

I know what you’re thinking… that’s a really big assumption that at some point in the future we will be pricing everything in Bitcoin. Michael Saylor’s price prediction is like something out of a sci-fi movie. So let me give you some thoughts on why this may not be as unbelievable as you may think. We’ll start by asking a fundamental question:

What is money?

Most of my thoughts on answering this question come from the brilliant series by Robert Breedlove where he and Saylor engage in a 10 hour dialogue about bitcoin, working from first principles. Here’s how they define it: Money is an energy network. It is the highest form of energy that human beings can channel. My money is essentially my portion of the collective achievement of human energy. I can then redistribute this energy any way I wish. This is why the phrase “money is power” is more than just a cliché.

In math terms, power output is simply work done over time. Money is stored power. In the business world, the more money I spend, the more work I can get done in the shortest amount of time – ie. power. So the question is, how can I store up power for myself and my family in the future without it depreciating?

Let’s say I want to send money across time to my grandkids. Where would I put it such that it will hold its value? Let’s walk through the benefits of using the means of either real estate or Bitcoin.

Let’s say I invest $1 million into a nice house in Toronto… okay, a shack… but in a great location. What are the chances that 50 years from now that property will hold its value? There are several risks which can be summed up in two ways: counterparty risk and entropy.

Real estate has counterparty risk. How do you know that someone will want to buy your house in the future? In order for me to hold my value, Canada cannot lose a war. The house is not portable, so its fate is tied to its location. Toronto must maintain its world class standing as a city with a robust economy. If not, the market will tank and I will lose my investment. Because the house is not fungible, I cannot trade it for an equivalent house in a better location one to one. There is also the risk of hyper-inflation… which could cause real estate prices to collapse, as it did in Venezuela in 2017.

Real estate has entropy. I must pay taxes on the house. Real estate in Canada is one of the few sectors we have that are thriving, and the government seems to want an ever greater piece of the pie. What if I want to take my money out of real estate? If I want to sell my house I need to pay a 5% fee to a realtor, I need to do work or pay to make it presentable, I need to wait for a buyer, then I need to wait another 30 plus days for closing. It will cost me $50 000 and 30 days, to sell a $1 million property. I’m at the mercy of the working hours of my realtor, lawyers, and buyers in order to make all of this happen.

Bitcoin is an entirely different story. It’s grown over 100% per year since inception. On the Bitcoin network I can move $1 million for a $15 fee in 30 minutes, 24/7. It holds basically no counterparty risk and is not dependent on the market of any one country or city. It is easily transported anywhere in the world. If Canada went south, one could hop on a plane and leave, easily taking their Blockchain keys with them on a USB or in their mind through a 24 word combination.

Here’s the key point: Bitcoin has the ability to channel the entire world’s monetary energy. It’s truly distributed. Think about it… my real-estate value is dependent on people wanting to move to my little Canadian city. Contrast that with the reality that anyone in the world with an internet connection can buy Bitcoin right now in seconds. When a billionaire in Singapore, or a hedge fund in Germany buys Bitcoin, I feel the effects immediately. Already in my short experience, I’ll wake up in the morning and my Bitcoin’s value is up 8% from when I went to sleep.

Bitcoin is like the LED lightbulb of monetary energy. As I write this, I sit in my bedroom under a lamp. I’ve thrown a t-shirt over the lamp shade so as not to cast too much light on my sleeping wife. I’ve tried doing this with other lamps and have ended up with burn stains on my shirt… but not with this light. This LED lightbulb barely emits any heat. Instead it channels its electric energy efficiently into photons with very little energy wasted.

In the same way Bitcoin is a low to zero entropy monetary network. The only loss of value is through fees. Those fees, however, are paid to miners who in turn secure the network. How much of my real estate taxes go toward securing the value of my real estate? I know at least some through provision of city maintenance and essential services, but we all know governments well enough to know that it isn’t spent very efficiently.

If real estate is an incandescent lightbulb, bitcoin is an LED. In the words of Saylor, “Bitcoin is the best system in the history of the world for controlling, storing and channeling energy, and that’s why it’s destined to be successful.”

In conclusion, my investment philosophy has changed. Whereas I once believed that I would use real estate as a path to retirement, I’m now considering shifting much of my resources to Bitcoin. I still believe in real estate and think it will do well as an asset class. But I can’t un-see what I’ve seen with Bitcoin. I believe that the next 10 years will look dramatically different than the past 10 years and that my investment strategy must change to adapt to what I believe will become the new normal.